are political contributions tax deductible for corporations

However there are still ways to donate and plenty of people have been taking advantage of. A tax deduction allows a person to reduce their income as a result of certain expenses.

Are Political Contributions Tax Deductible Anedot

This form itemizes your taxes to understand better what is or is not.

. Direct contributions arent tax deductible but there are ways to support candidates and causes with a tax break. The Political Contribution Tax Credit allows individuals or corporations that make donations to qualifying political parties or election candidates to claim a tax credit. Nondeductible Lobbying Expenditures An.

These taxes should be documented and kept for future reference. Are corporate political contributions tax deductible. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you.

This form itemizes your taxes to understand better what is or is not. Ad Talk to a 1-800Accountant Small Business Tax expert. Your business cant deduct political contributions donations or payments.

You are to itemize your taxes on form 1040 Schedule A. Political contributions are defined as. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

This is based on the maximum allowable annual contributions of 19950. The maximum tax credit that a corporation can claim in a tax year is 2294. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations.

The simple answer to whether or not political donations are tax deductible is no However there are still ways to donate and plenty of people have been taking advantage of. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. But corporations are not allowed to make direct political.

Charitable contributions are tax deductible but unfortunately political campaigns. The simple answer to whether or not political donations are tax deductible is no. Some contributions can be made to the educational arm of a political organization when those arms are qualified under.

But as per the Companies Act 2013. The problem with this approach is that the LDA amounts may be overly broad for tax purposes and may include expenditures that are deductible. We have the experience and knowledge to help you with whatever questions you have.

There is no maximum applicable limit on the contributions made to political parties under Section 80GGB of the Income Tax Act. Generally donations to these entities are used for advocacy but not direct electoral purposes where youre asking someone to support. Are political contributions tax-deductible for my business.

What contributions are tax deductible. There are five types of deductions for. A corporation may deduct qualified contributions of up to 25 percent of its taxable.

Get the tax answers you need. Political contributions arent tax deductible. Posted on Jul 26 2009 Usually theyre not deductible.

Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes. Donations to this entity are not tax deductible though. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in federal state and local elections and.

In 2022 an individual may. Businesses likewise cannot claim a deduction for political contributions whether theyre pass-through entities or file a corporate return. Contributions that exceed that amount can carry over to the next tax year.

Eligible contributions An eligible.

Corporations Are Spending Millions On Lobbying To Avoid Taxes Public Citizen

Are Political Donations Tax Deductible Credit Karma

Join Us January 6 2022 Bruce Thompson For Ga Labor Commissioner

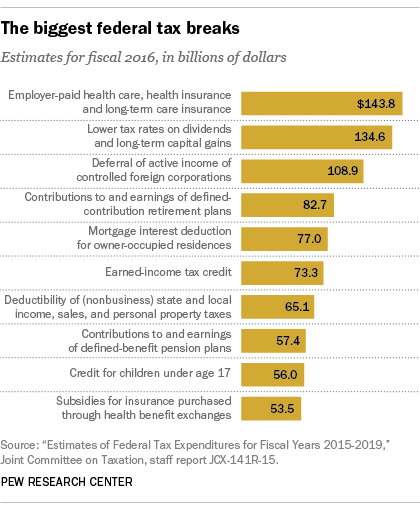

The Biggest U S Tax Breaks Pew Research Center

Dscc Virtual Spring Reception New York Senate Democrats

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible H R Block

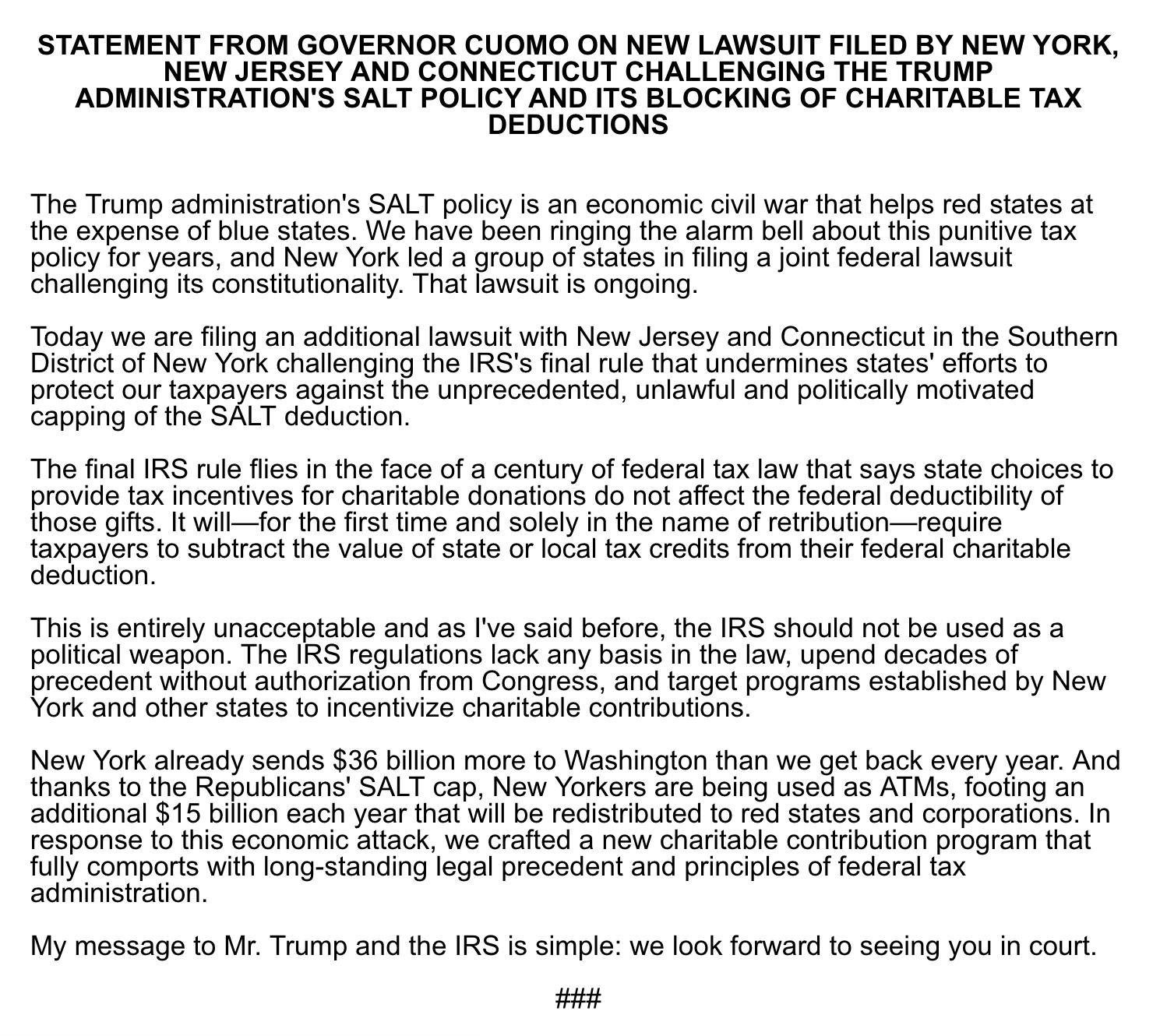

تويتر Archive Governor Andrew Cuomo على تويتر Breaking New York Just Filed A Joint Lawsuit With N J And Connecticut Challenging The Trump Administration S Politically Motivated Salt Policy And Its Blocking Of

Are Political Contributions Tax Deductible Anedot

What Is The Dividends Received Deduction Universal Cpa Review

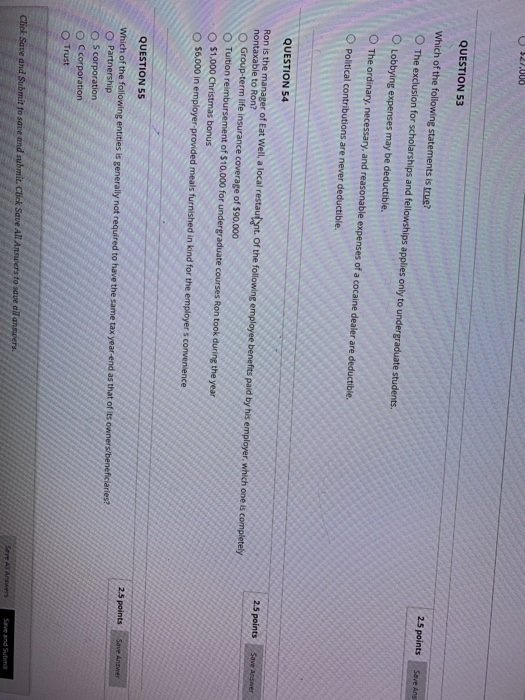

Solved 27 000 Question 53 Which Of The Following Statements Chegg Com

Are Campaign Contributions Tax Deductible

-Kelly-Smith-sPAqLWGKHWt6fR7kh.png)

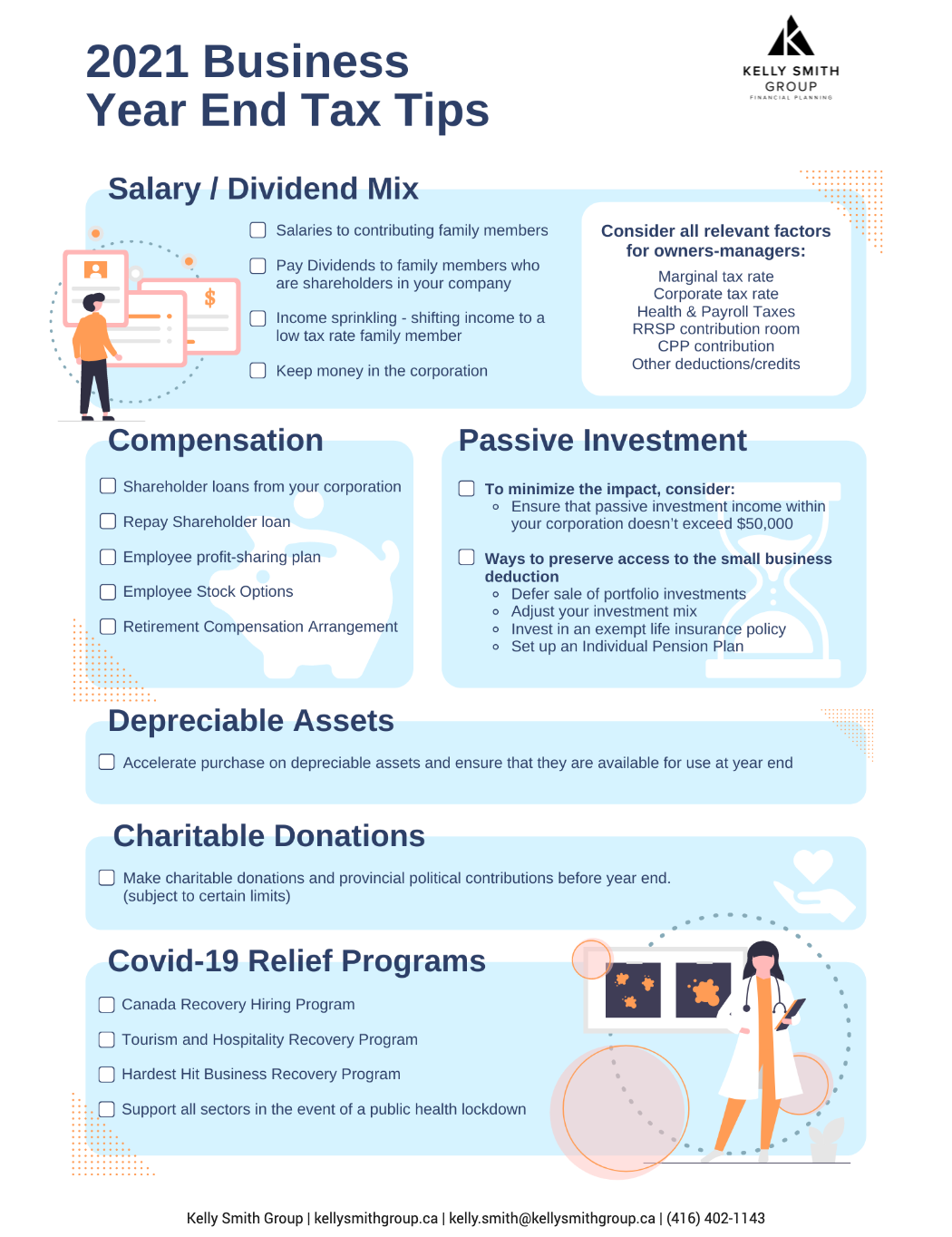

2021 Year End Tax Tips For Business Owners Kelly Smith Group

Tax Report Is Your Political Donation Deductible Wsj

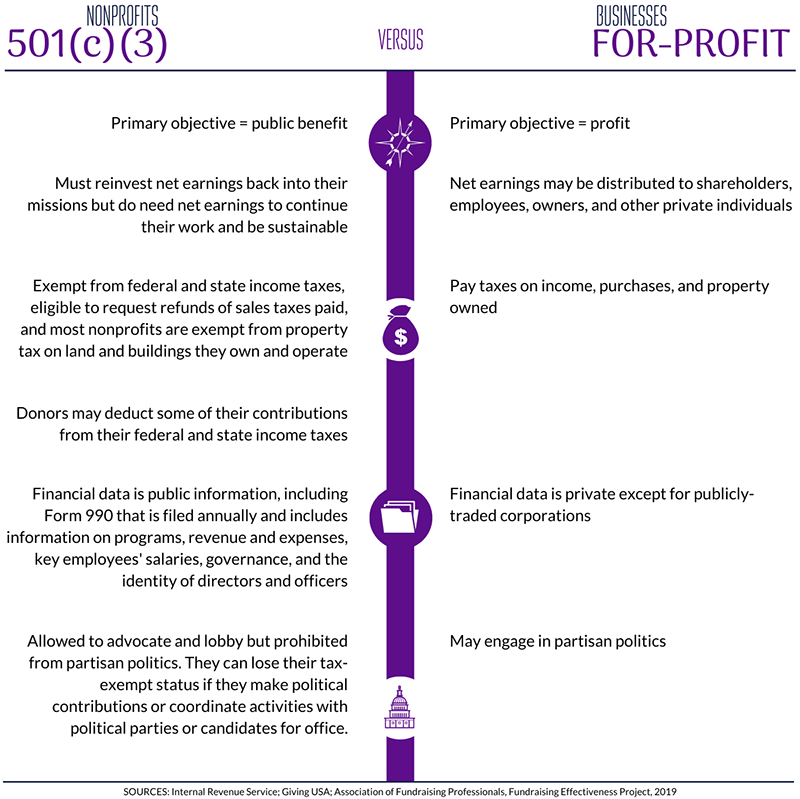

Nonprofits Impact On North Carolina North Carolina Center For Nonprofits